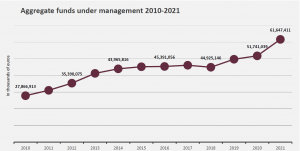

- Funds under management grew 19% to €61.64bn

- Credit investment in Andorra, at €4.99bn, rose 0,2% with a 13% increase in new mortgages compared to 2019

- Financial institutions reported an improved solvency ratio of 17.03% (CET1 phase-in)

- Commercial activity as measured by payment transactions gained momentum and exceeded pre-pandemic levels

Andorran banks closed the year 2021 with an overall profit of €102m, a figure close to pre-pandemic levels. In a year marked by the acquisition of BancSabadell d’Andorra by MoraBanc and of Vall Banc by Crèdit Andorrà, banks managed to grow their profits by 22% and increase the volume of client funds under management by 19%, to €61.64bn. Credit investment in Andorra also rose by 0,2% to almost €5bn. This line of business reported 884 new mortgages for a total loaned amount of €317.5m, a figure well above 2019 levels.

Banking activity picked up thanks to the reactivation of the tourism industry. Both the volume and number of domestic and international credit and debit card transactions were higher in the second half of 2021 than in 2019.

Concentration of the Andorran banking sector

Andorran banks remained solid with strong capitalisation and a CET1 (phase-in) solvency ratio of 17.03% as at 31 December 2021, slightly below the previous year with 18%, but above the average for European banks at 15.4%, according to data from the EBA for the third quarter of 2021.

This ratio was affected by the M&As that took place in the Andorran marketplace. MoraBanc acquired 50.97% of BancSabadell d’Andorra, now BSABanc, from BancSabadell for €68m, and made an offer to purchase shares from minority shareholders with a view to completing the merger by the end of 2022. Crèdit Andorrà also completed the acquisition of 100% of Vall Banc on 11 February 2022. The concentration of Andorran banks should lead to a more efficient, more resilient and more responsive banking system for clients.

The financial profitability of banks, as measured by ROE, recovered in 2021 and now enjoys a consolidated ratio of 6.33% despite low interest rates, M&As in the banking sector, ongoing adaptation to international banking regulations, and technological investments that continue to put pressure on results in the sector.

The liquidity ratio (LCR) was 206%, which is also higher than the average for European banks, at 174% at the end of the third quarter of 2021. And the default rate dropped to 3.74% in 2021, from 4.49% in 2020.

All these figures provide a preview of the official closure on 31 December 2021 and have yet to be reviewed by auditors and approved by the management board of each bank.

The general manager of Andorran Banking, Esther Puigcercós, stressed that “2021 has been a year of recovery and optimism, leaving behind the economic consequences of the pandemic. Andorran banks have maintained their strength and attractiveness in terms of securing new client funds and growing profits.”

As far as the banking consolidation process is concerned, Esther Puigcercós emphasized that “our financial system and institutions are more consolidated, more efficient and more capable of meeting the needs of our clients, complying with regulatory requirements, and satisfying the demands of financial markets, which are increasingly global and faced with a higher level of competition and excellence”.

Covid measures

At the end of 2021, 7.75% of the amount granted in soft loans under the special guarantee scheme set up for companies and businesses at the beginning of the health crisis had already been repaid and now accounts for 15.26% of credit granted. In total, 2,019 soft loans have been granted to companies and the self-employed for an overall value of €152m.

Andorran banks also approved a total of 353 mortgage and non-mortgage grace periods for those affected by the Covid-19 crisis. By the end of 2021, all grace periods had expired.