Basic features

A sector with highly qualified professionals and a stable social and political environment

A sector with highly qualified professionals and a stable social and political environment

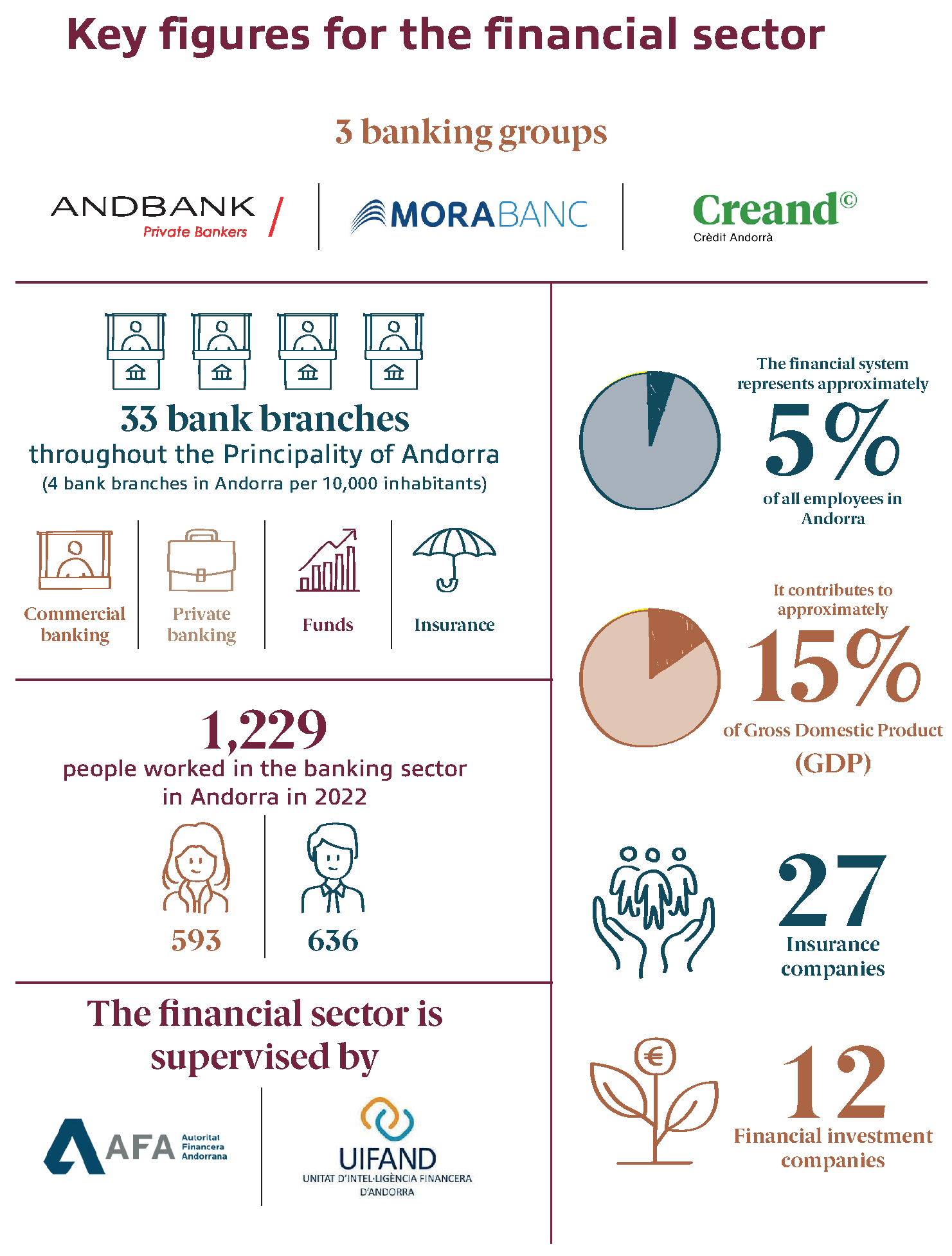

The Andorran banking sector has over 90 years of experience. It is based on a universal banking model, without overlooking specialised banking services, retail banking, private banking and asset management. Andorran banks offer a full range of banking services including loans and credit, asset management and financial consultancy, operations with liabilities, financial analysis and other services (credit cards, transfers, etc.). They also have specialised subsidiaries of financing, insurance and asset management firms.

This sector, with its highly qualified professionals and its politically and socially stable environment in a country with more than 700 years of history, tradition and dynamism, is regulated and supervised by the Andorran Finantial Authority (AFA). This body is governed by Law 10/2013, which took effect on 20 June 2013, replacing Law 14/2003 of 23 October.

The financial sector is a cornerstone of Andorran’s economy due to its significant contribution to the country’s GDP (the financial and insurance sector accounts for approximately 15%), with its banking system at the core. Some of the other financial players in the Principality include insurance companies, asset management firms, investment firms and non-bank credit institutions.