- The CET1 (phase-in) capital ratio rises to 17.71%

- Banks make provisions of €33m to deal with the pandemic situation

- Gross lending grows by 4.5% to reach €6.3bn

- Soft loans worth €135m and moratoria on the repayment of loans with an outstanding balance of €122m have been granted to companies and businesses

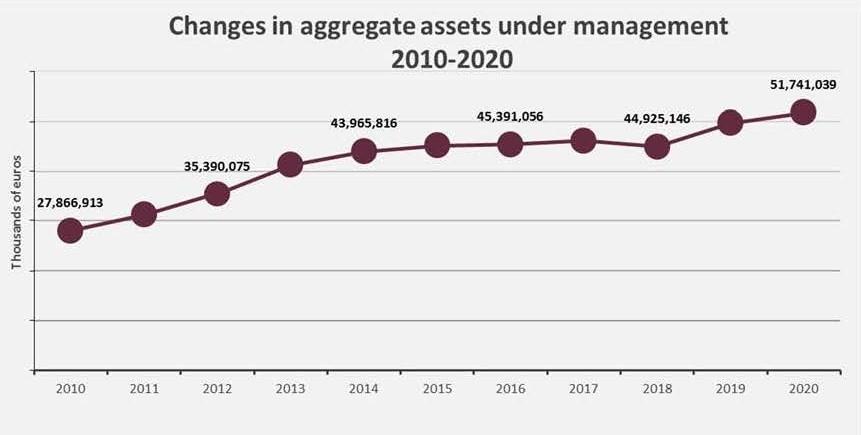

In a year marked by COVID-19, Andorran banks have closed 2020 with an aggregate result of €84m following the extraordinary provisions of €33m made in accordance with the recommendations of the supervisor and international guidelines. Despite this, banks have increased their volume of assets under management by 4% to €51.7bn. Lending has increased by 4.5% and the CET1 (phase-in) capital ratio has risen to 17.71%. All of these figures offer a preview of the official ones at 31 December 2020, which will be reviewed by auditors and approved by the management board of each bank.

The combination of low interest rates, continuing adaptation to international banking regulations and heavy investment in technology put pressure on the sector’s results with a return on equity (ROE) of 5.37%—above the average for European banks (2.12% according to ECB data for the 3rd quarter of 2020).

Andorran Banking’s general manager, Esther Puigcercós, stresses that “while 2020 has been a challenging year marked by the impact of the pandemic, Andorran institutions have maintained their strength and attractiveness in terms of securing new customer funds. The provisions made to cope with the health crisis have had a significant impact on the profit and loss account, without harming the banks’ solid position in terms of solvency and liquidity”.

The CET1 (phase-in) capital ratio stood at 17.71% as of 31 December 2020, slightly above the previous year with 17.48%, and above the average for European banks, at 15.21% according to data from the European Central Bank (ECB) for the 3rd quarter of 2020. The liquidity ratio (LCR) is 187%, also higher than the average for European banks which was 170% at the end of the 3rd quarter of 2020.

Covid measures

Andorran banks have provided support to local government bodies, companies, businesses and households. Gross lending grew by 4.5% to reach €6.3bn in 2020. According to statements by Ms Esther Puigcercós, “in a year heavily marked by the economic situation caused by the pandemic, Andorran banks have maintained the strength that will enable them to continue to help families and businesses.”

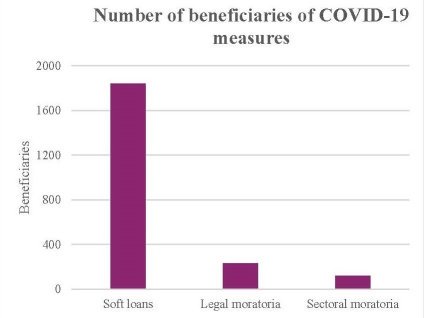

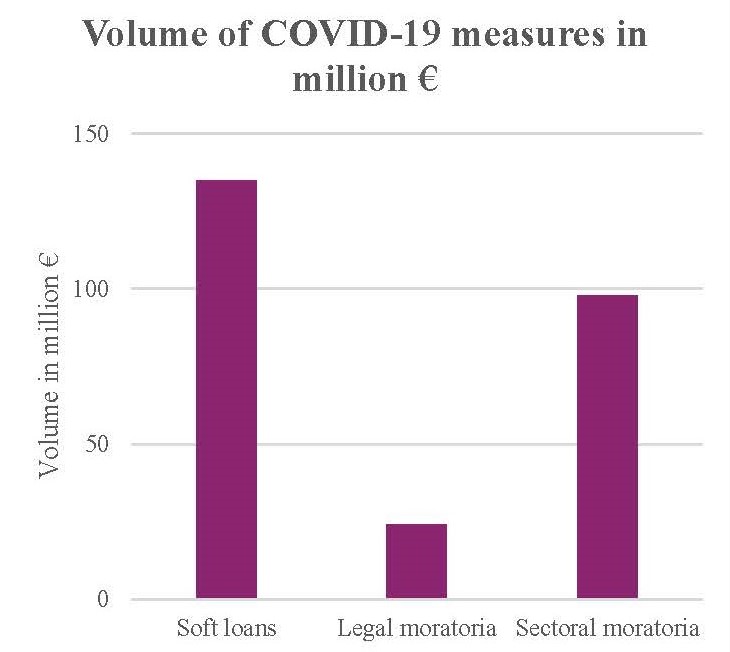

As part of the loan guarantee scheme for companies and businesses launched at the beginning of the health crisis to support Andorran business and protect jobs, 1,875 soft loans worth €135m have been granted out of the €230m available to companies and self-employed people.

According to data for the end of 2020, Andorran banks have granted a total of 353 moratoria on mortgage and non-mortgage loans to those affected by the Covid-19 crisis, with an outstanding balance of €122m.

The information includes both the legal moratoria on loans and mortgages approved by Law 5/2020, of 18 April, on new exceptional and urgent measures for the SARS-CoV-2 pandemic, and the sectoral moratoria promoted by Andorran Banking to alleviate the extraordinary situation linked to the temporary lack of liquidity faced by bank customers as a result of the Covid-19 crisis.

Of all the moratoria granted, 65% relate to the legal moratoria, but the outstanding balance to be repaid only accounts for 20% of the total. At the end of the year, 122 legal moratoria on mortgage loans had been completed for an outstanding balance of €23m. 100% of the beneficiaries of these moratoria are salaried workers and self-employed people who have seen their income fall due to Covid-19.

The Association approved sectoral moratoria in an effort to expand and complement the scope of the legal moratoria available to individuals and companies. In total, 121 moratoria were granted, 79 of which were for mortgage loans for a value of €91m.