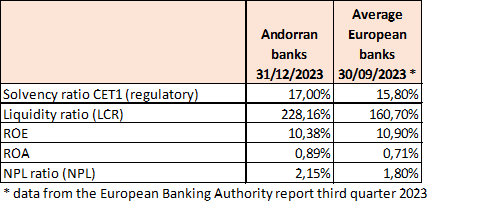

- The Andorran banking business model has proven to be sustainable over time, profitable with a ROE of 10.38% and diversified both in the type of banking offered to its customers and geographically.

- The entities enjoy a sound and well-managed balance sheet with a solvency ratio (CET1 regulatory) of 17% and a liquidity ratio (LCR) of 228.16%, which is higher than the requirements set by the regulator and the average for European banks.

- The banking sector supports the country’s economic growth with new financing to the tune of €1,047 million, representing 30% of GDP, and maintains a healthy balance sheet with a low non-performing loan ratio of 2.1%.

Andorra’s banking sector closed the 2023 financial year with an aggregate result of €163 million for the three banking entities, thanks in large part to the boost in income generated by the increase in interest rates and by the adaptation of the business to the new environment and the needs of the clients. The banking industry recorded a 44% growth in profits and a 16% rise in the volume of customer funds under management, reaching €74.187bn.

The banks’ business model demonstrates its resilience and sustainability. Together, Andorra’s three banks have achieved a return on equity (ROE) of 10.38%, in line with the average return of European banks (EBA data for the third quarter of 2023), and up 281 basis points from 7.57% in 2022. The banking sector’s return on assets, as measured by ROA, amounted to 0.89%, an improvement compared to 0.66% in 2022 and above the European average.

During 2023, the boost in income due to the rise in interest rate has made the traditional lending activity profitable and has empowered profit. On the other hand, the market continues to adapt to international banking regulations and investments in technology continue to put pressure on results. The banking sector’s performance is key to instil confidence in the markets and supporting national economic growth.

The strength and diversification of Andorra’s banking sector

The Andorran banking sector remains robust and enjoys strong capitalization with CET1 solvency ratio of 17% as at 31 December 2023 (15.76% at 31 December 2022). This is higher than the average of European banks, which stood at 15.80% according to EBA data for the third quarter of 2023.

The liquidity ratio (LCR) is 228.16%, well above the minimum of 100% set by European regulators and above the average of European banks, which stood at 160% at the end of the third quarter of 2023. Despite the increase in the Euribor, the NPL ratio continues its downward trend, to a historical low of 2.1% at the end of 2023 (3.3% in 2022, 3.7% in 2021 and 5.32% in 2019). The good dynamics of the Andorran economy, together with the solid credit granting and credit risk monitoring policies of the banking institutions, have resulted in a reduction of the non-performing loans ratio to historic lows.

Esther Puigcercós, Managing Director of Andorran Banking, emphasizes that “Andorran institutions have a sound capital position with liquidity ratios above the average for European banks. Having a solid banking sector is key to boosting the growth and competitiveness of the economy”.

These figures are a preview of the official closing data as at 31 December 2023, which have yet to be reviewed by auditors and approved by the Board of each entity.

Andorran banks drive the country’s economic growth

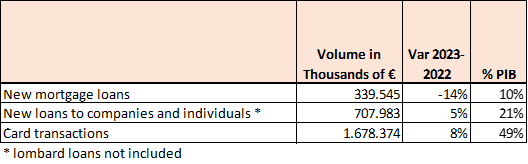

The sector has supported the growth of the Andorran economy in 2023 with a local banking model that is closer to its clients. In an environment of high interest rates, the sector has intensified its action to be close to the projects of individuals, companies and institutions. While the total amount of credit investment remained stable at around €5 billion, 664 new mortgages were granted to households for a total amount of €339 million (-14% compared to 2022), which still represents a significant percentage of GDP (10%). New loans to companies and individuals amounted to €707 million, up 5% from 2022, and accounted for 21% of national GDP. Also, the banking sector drove consumer spending through the various means of payment available, with an 8% increase in the volume of credit and debit transactions at €1,678 million, accounting for 49% of GDP.

In the latest IMF report, published on March 6, the international organization highlights the important role played by the Andorran banking sector in the economy. The financial sector is the fourth most important sector in the Andorran economy. The report makes a complete analysis of the sector’s main indicators, comparing them with those of peer countries such as Luxembourg, Liechtenstein, Switzerland and Monaco, among others. According to the IMF, the size and sound capital positions of Andorran banks, interest rates and economic growth are key to the profitability of our institutions.

According to the international organization, Andorran banks benefit from having a more diversified portfolio of services compared to its competitors. It highlights the benefits of a banking system that combines commercial banking focused on the domestic market with private banking with more than 90 years of experience.

Puigcercós highlight that “as described by the IMF, thanks to the diversification of the Andorran banks, which was implemented more than 20 years ago, we have a competitive sector prepared to face future challenges. Andorran banks manage their clients’ resources on the private banking side while at the same time being financial intermediaries for the domestic economy.”

The latest report of the Andorran Banking Observatory, published last January, highlights the task of the banking sector in boosting strategic sectors and energizing the economy through its financing. At the end of 2022, credit investment granted to companies and families represented 173% of GDP, which, according to the IMF, is the highest percentage compared to Andorra’s peers.