Moneyval confirms progress towards full approval

Andorran banks consolidate their position with 44.9 billion euros of funds under management

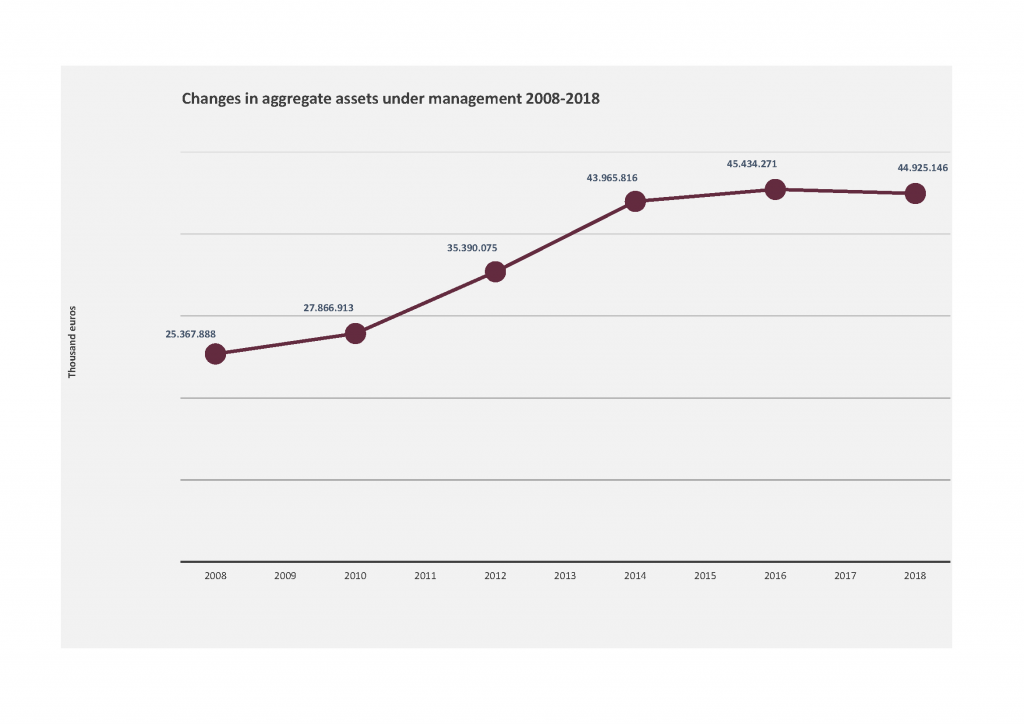

- Client funds have almost doubled in the last 10 years

- Profits stand at 100 million euros in a year of heavy investments

- New loans have risen by 27.90% with an injection of 970 million euros into the real economy in an effort to finance households and businesses

- Andorran banks maintain a high solvency rate with a CET 1 (phase-in) ratio of 16.30% and a ROE of 7.31%, which is higher than the average for European banks

The Andorran banking sector ended the year 2018 on a high note with a total of 44.9 billion euros of funds under management, a figure that has remained stable over the past three years, but which has almost doubled in the last decade (see graph below).

The general manager of Andorran Banking, Esther Puigcercós, points out that “Andorra’s banking sector remains sound and solid, with outstanding creditworthiness, a financial return (ROE) above the European average, and a strong capacity to extend credit to businesses and households despite the expected decline in profits due to the global banking environment”. The Andorran banking industry has achieved profits of 100 million euros despite an economic environment of low interest rates, falling share prices in the last year, and heavy investments in technology and compliance with new regulations.

Banks injected 970 million euros (+27.90% more than the previous year) into the real economy, in the form of loans and credit to businesses and individuals, following the economic recovery and an increase in demand. In spite of this, global credit investment amounted to 5.9 billion euros, 1.23% less than the previous year due to the repayment of existing loans.

In 2018, Andorran banks maintained their international credit ratings, which shows the rating agencies’ confidence in the sector as banks maintain solid foundations. Another important indicator that shows the sustainability and confidence of the Andorran banking sector is the financial return (ROE), which stands at 7.31%, above the average for European banks (6.85% according to EBA data for the 3rd quarter of 2018).

The CET 1 (phase-in) solvency ratio -calculated on a comparative basis- was 16.30% on 31 December 2018, which is higher than the average for European banks (14.18% according to EBA data for the 3rd quarter of 2018). 2019 will be the first year in which banks will report the solvency ratio according to the European criteria of Basel III following the entry into force, in January 2019, of the law on the solvency, liquidity and prudential supervision of financial institutions and investment firms.

Investment in technology is prioritised over profits, paving the way for a new business model

The Andorran banking sector is facing the final part of its transformation process to define a business model adapted to the changes that have occurred in the marketplace and the business environment. The trend in the industry has been to prioritise technological investment, especially in digital transformation projects, which attracted 30 million euros worth of investment in 2018, and to focus on upgrading the equipment and processes to implement in record time the regulatory revolution that European banks have also faced.

Confidence in the Andorran banking industry was further strengthened by Moneyval’s 2018 report, which highlights the efforts made by Andorra in terms of the prevention of money laundering and its recognition as a cooperating country according to the ECOFIN.

According to Puigcercós, “2018 has been a year in which we have made progress towards full approval. As a banking centre, we can face the future with strong assets and experienced professionals; a growing domestic economy; an international market with many opportunities; high creditworthiness and strength; a digital transformation process and advanced regulations.”

Download article published in La Vanguardia 25/04/2019

Download article published in La Vanguardia 25/04/2019